Our Services

Investment Systems

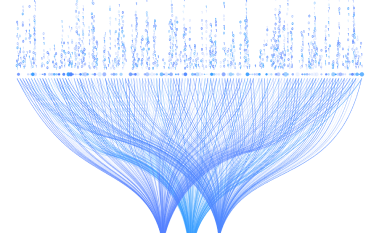

Development of algorithmic investment systems, which infer behavioral patterns of assets, taking directional positions according to the opportunities that arise.

Investment Portfolios

Construction of intelligent, balanced and dynamic investment portfolios, which capture robust quantitative phenomena and whose purpose is to deliver investment alternatives with great return potential and low correlation with other investments.

Investment Advisory

Advice and active management of personal investment portfolios. Instrument selection and asset allocation based on the client's risk profile and return objectives.